A multinational specialty pharmaceutical group, headquartered in Europe, had recently set-up its business in India. As a start-up in the pharma sector in India, the company had limited visibility on the ever-changing and complex tax, compliance and regulatory environment surrounding the business.

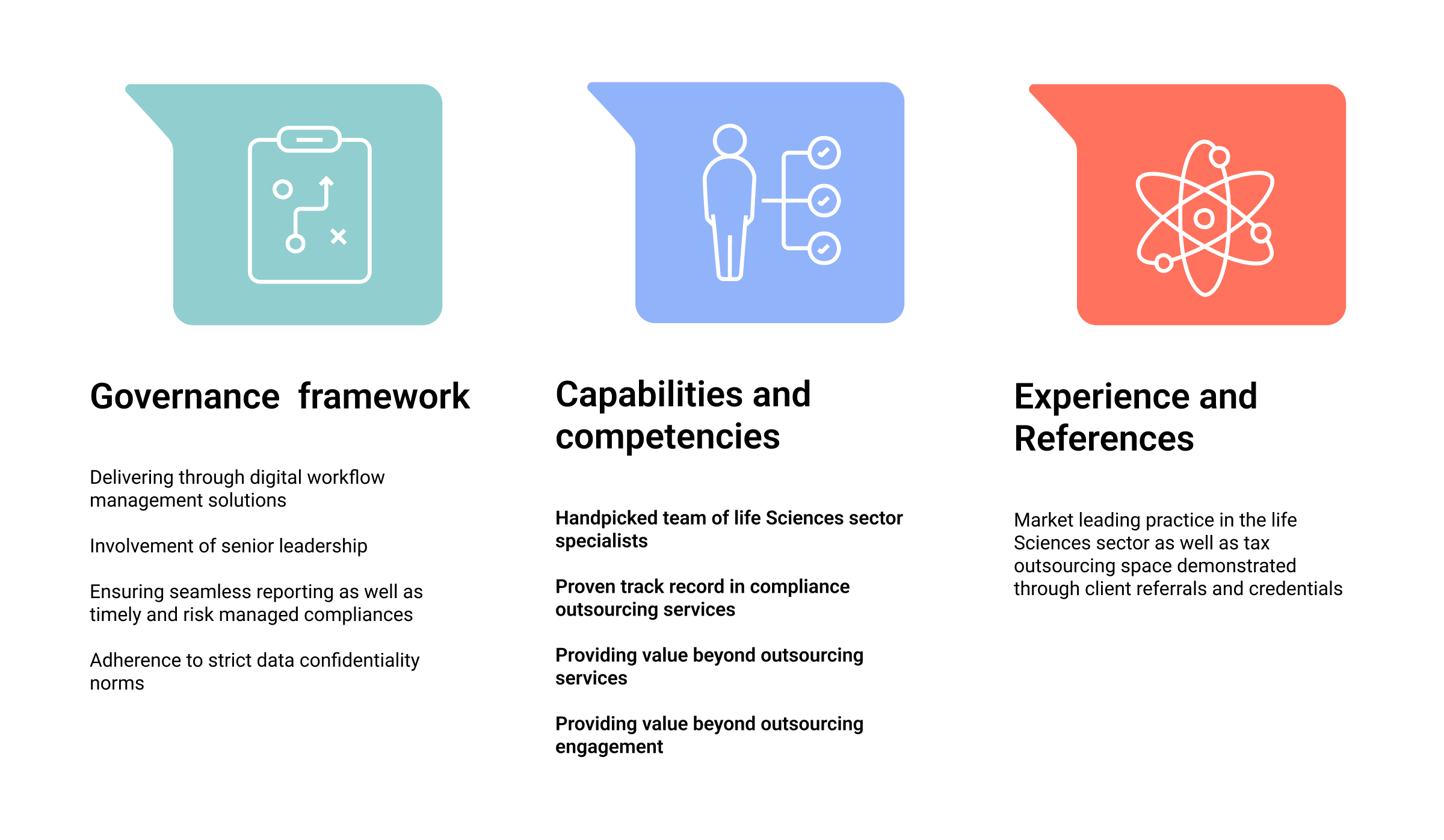

With growing digitalization of tax and finance compliances across the globe and in India, the company was looking at a solution that leveraged digital solutions to help them in driving long-term efficiencies and agility in their tax and finance functions.